LinkedIn is one interesting “Social” network, and their new content strategy makes a lot of sense to me. Here is why.

Even though LinkedIn is not as viral as Facebook or Twitter, it has proven to monetize well ($8 annually per monthly user compared to Facebook’s $1.5). The higher revenue per active user opens the door to exploring new types of business strategies, including one that you might not expect a social network to go after – a content strategy. To clarify, this is not about LinkedIn buying paid content or distributing paid articles about how awesome LinkedIn is. It’s actually a strategy targeted right at heart of one of LinkedIn’s biggest challenges – increasing engagement.

Backing out a bit to restate the obvious, every freemium product needs to first nail acquisition, then engagement, and finally monetization. Each requirement is not standalone, acquisition is a pre-request for engagement, and without an engaged userbase it becomes extremely hard to drive meaningful revenues.

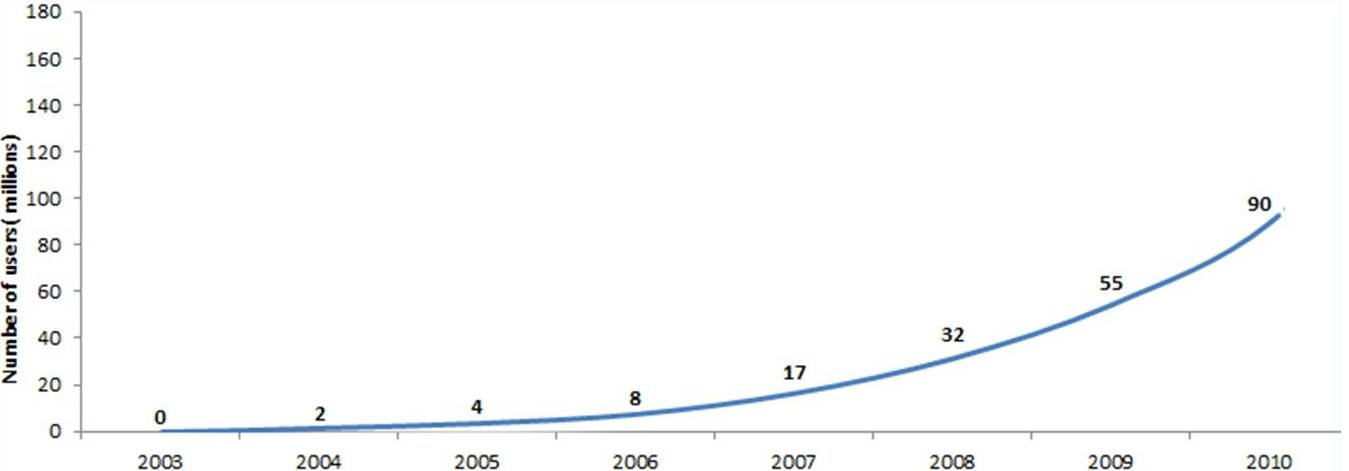

In it’s infancy, back in 2002-2004, LinkedIn was actually slow to grow and it took quite a few years to ramp-up user acquisition (One reason might be that LinkedIn was just early to the market and people could not see the value until the network effect was fully in place). A few years later and with a few great tricks up their sleeves (including rumored Reid Huffman’s “loss aversion” invite acceptance tactics) they finally got there.

In the meanwhile, building on one segment of super active users – recruiters, LinkedIn was able to launch money making products -Â Talent solutions (The companies cash cow accounting for ~50% of revenue), Advertising (~25% of revenue) and later premium subscriptions.

So LinkedIn has figured the first step – user acquisition (including activation and network effect) and then jumped directly to the step 3 – monetization. Meanwhile, engagement was doing well, but not as great as some of the other metrics compared to other “Social” networks. It all makes perfect sense. The long tail of LinkedIn users were not really using the product daily. Unlike Facebook, the action on LinkedIn is not as compelling for most people. Users don’t come to LinkedIn to check-up on their friends, they come to find their next big gig.

Circling back to content strategies, comes 2013 and suddenly LinkedIn is all about content. They started with the launch of the Influencer product and pushed it hard with massive email campaigns to users and front page promotion. More recently they bought Pulse to help target the best content for users.  What’s interesting about this is that it’s sort of opposite to anything else that is happening out there. Content businesses online are actually facing more challenges than ever – banner ads, the bread and butter for many businesses are becoming less and less effective (just look at Yahoo’s latest earning reports). Content players are finding it increasingly hard to drive revenues for their work and are becoming less sexy as a business.

Actually, the acquisition of Pulse itself is a good indication of the challenges content companies and content related technologies are facing. Pulse is reported to have more than 30 million active monthly users, which is big by any standard and especially so in mobile with challenges around retention. However, Pulse was bought for $90m - That’s $3 per active monthly user – Meanwhile LinkedIn has ~150 million active users each month but is worth over $19b, that is no less then $126 per active monthly user.

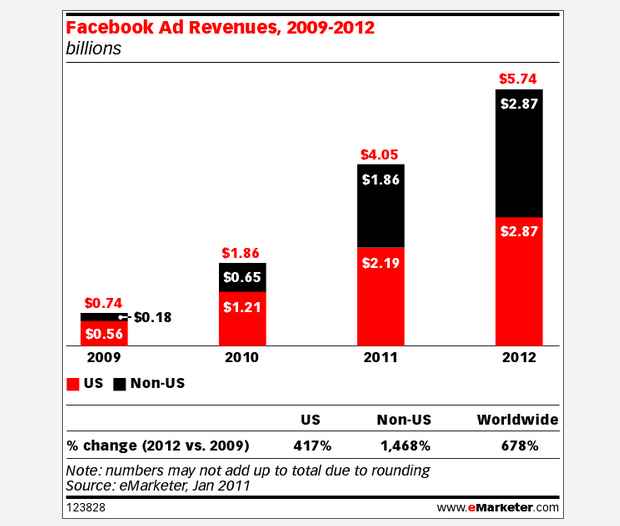

Then why is LinkedIn suddenly focus on content? well… LinkedIn has found a way to flip this model on it’s head. With great monetization it suddenly makes a lot of sense to engage users by leveraging content.  Think about it for a second – LinkedIn has the audience and knows how to make money out of it. Additionally, LinkedIn has a strong ad-based product. The equation in the ad business is actually really simple – more pageviews = more revenue, and that is exactly the low hanging fruit that LinkedIn is after.

The content challenge for LinkedIn to make their product one that is used daily and becomes part of a “ritual”, resulting is sustained engagement. If users get used to reading high quality news at LinkedIn the engagement challenge is essentially solved, driving ad revenue up first, but even more important for the longer term, fueling growth across all products.